Feature 1

Add more detail about this feature, such as benefits, appearance, components and value

Give your loved ones something that will keep providing for them when you no longer can. If you have people who rely on your income and support, you want to make sure that they can still achieve everything that you were hoping they would. Your small investment is worth their future security.

The insured celebration rested on the plan application. The insured left out health and wellness issues or risky pastimes or activities like skydiving. Insurance firms can postpone settlement for six to twelve month if the insured event dies within the initial two years of the policy. Payment Choices You can also assist determine just how your survivor benefit will be paid out after you pass away - American Income Life.

1

Lump-Sum Settlements Because the creation of the sector much more than 200 years earlier, beneficiaries have actually generally received lump-sum repayments of the earnings. The default payout alternative of the majority of policies remains a round figure, says Richard Reich, president of Intramark Insurance policy Services, Inc. Installments and also Annuities Modern life insurance policy plans have seen a significant improvement in just how payments can be provided to the plan's beneficiaries, says Bernstein.

2

These selections provide the plan proprietor the possibility to pick a pre-determined, surefire revenue stream of in between five and 40 years. "For income-protection life insurance, a lot of life insurance policy customers favor the installment option to assure the profits will last for the needed number of years," states Bernstein. Recipients should bear in mind that any passion earnings they obtain undergoes taxation (Life insurance companies near me).

3

Preserved Property Account Some insurance companies supply beneficiaries of large plans a checkbook instead of a round figure or normal installations. The insurer, functioning as a financial institution or banks, keeps the payment in an account, allowing you to create checks against the equilibrium. Such an account would certainly not permit deposits however would pay rate of interest to the beneficiary.

4

Generally, life insurance policy policies will only pay out at the time of the policyholder's fatality. Talk with your insurance policy agent concerning whether this option makes feeling for you.

5

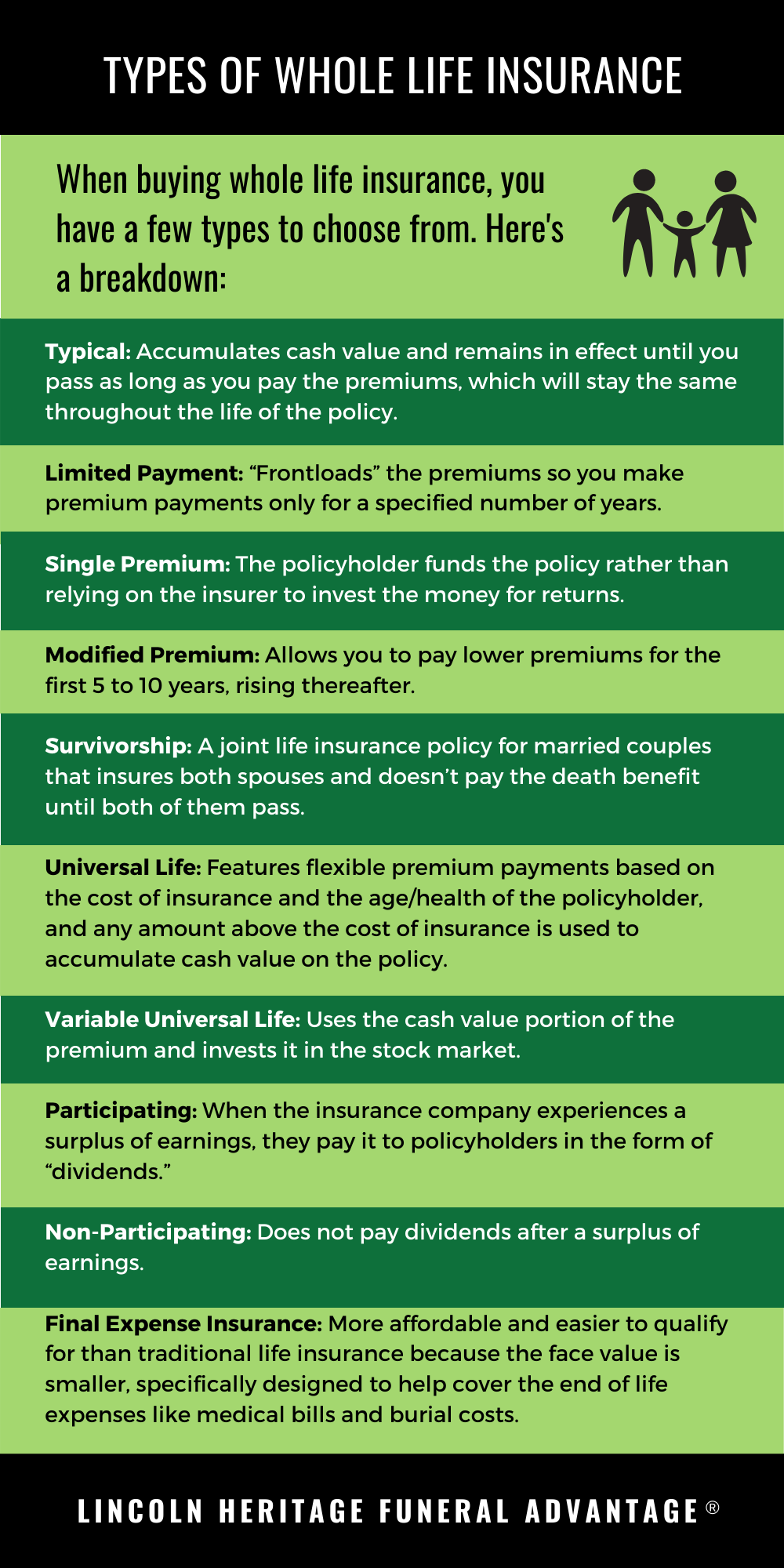

Recognizing exactly how the procedure works, from buying life insurance policy to suing to obtaining a payment, can help you wage your plans to purchase protection confidently. Whole life insurance.

6

Initially created to aid cover burial expenses and also treatment for widows and also orphans, life insurance policy is now an adaptable and effective monetary product. Majority of Americans have some kind of life insurance coverage, according to insurance coverage research study organization LIMRA.Life insurance policy can be provided as either a specific or group plan.

7

What is life insurance policy? Life insurance coverage is an agreement between you and an insurance firm (Life insurance online).

8

Term life covers you for a repaired amount of time while irreversible life insurance policy covers you up until the end of your life., construct cash worth over time and also do not expire, if you've paid your premiums.

9

The best insurance for you in 2022Use our Best-Of Awards checklist to obtain the year's finest vehicle as well as term life insurance policy. Exactly how term life insurance policy works, Term life insurance policy is protection that lasts for an amount of time chosen at acquisition. This sort of life insurance policy typically covers 10-, 20- or even 30-year periods.

10

Address: Louisville, KY

If you don't die throughout that time, no one obtains paid. Term life is preferred since it provides huge payouts at a reduced price than long-term life.

11

You have a home mortgage that you do not want to saddle your spouse with after your fatality. You can not pay for the greater premiums of irreversible life insurance and also still desire insurance coverage. There are some variations on typical term life insurance policy plans. Convertible policies allow you to transform them to long-term life policies at a higher price, permitting for longer, much more adaptable insurance coverage.

12

How long-term life insurance coverage functionsIrreversible life insurance policy policies cover you until fatality, thinking you pay your costs. Whole life is the most well-known version of this type of life insurance policy, but there are various other tastes, including global life as well as variable life. Long-term life insurance coverage plans build money value as they age. American Income Life.

13

Cash money value typically rises quickly at the beginning of a plan's life, when you're more youthful as well as less costly to insure. Whole life policies boost money value at a set price, while universal policies vary with the market. It requires time to build the cash money value in these accounts, which you must consider when getting life insurance.

14

You can borrow from it, make withdrawals or simply utilize the interest settlements to cover the premium later in life. You can even give up the policy, trading your fatality benefit for the value presently in the account, minus some fees. All of these alternatives can develop complicated tax concerns, so be sure you speak with a fee-based economic advisor before tapping your cash value.

15

Whole life premiums are a great deal greater than term life insurance policy premiums. If you contrast ordinary life insurance policy prices, you can see the distinction. $500,000 of entire life insurance coverage for a healthy 30-year-old woman costs around $3,558 yearly, on standard. That same level of insurance coverage with a 20-year term life plan would certainly cost approximately about $193 every year - Whole life insurance.

16

Universal life plans allow you to make bigger or smaller sized settlements, depending on your finances or exactly how the financial investment account performs. If things work out, you might be able to quit paying. If not, you might need to increase the quantity you pay to cover the shortage. Various other permanent life insurance policy choicesIndexed global life, IUL, is a kind of universal life insurance coverage that places investments into index funds, made by the insurance firm, which attempt to track the stock exchange.

17

This is a block description. To edit this description, click on the text and replace it with your own content. Use this space to convert site visitors into customers with a promotion